Company Information

Ask for more detail from the seller

Contact SupplierTerm insurance is a type of life insurance that offers financial protection for specific period of time, or term, in exchange for a fixed premium. If the insured dies during the policy term, the benefit is paid to the beneficiary.

Here are some things to consider about term insurance:

Policy term

Term insurance policies can be for 10, 20, or 30 years.

Premium payment

Premiums can be paid at once or regularly for the entire policy term or for a limited period.

Policy types

There are different types of term insurance plans, including level, increasing, and decreasing term plans.

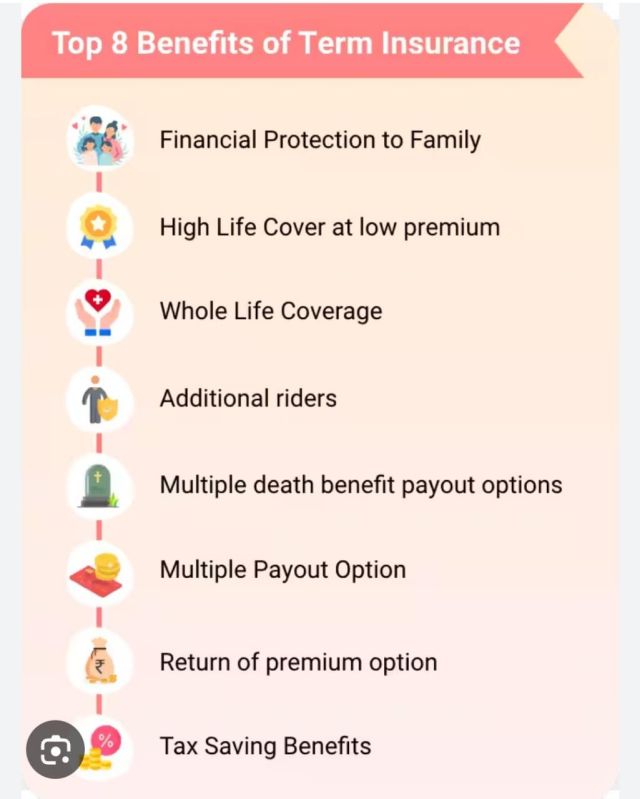

Policy benefits

Some policies offer benefits like terminal illness benefit and permanent disability waiver.

Tax benefits

Some policies offer tax benefits on premiums paid and tax-free claims payout and returns.

Policy renewal

If a policyholder renews their policy after the initial term, the premiums will be higher based on their current age.

Guaranteed re-insurability

Some policies offer guaranteed re-insurability, but these features may cost more.