Listing ID #2831193

Company Information

Ask for more detail from the seller

Contact SupplierGoods and Services Tax (GST) is an indirect tax which was introduced in India on 1 July 2017 and was applicable throughout India which replaced multiple cascading taxes levied by the central and state governments. It was introduced as The Constitution (One Hundred and First Amendment) Act 2017, following the passage of Constitution 122nd Amendment Bill. The GST is governed by a GST Council and its Chairman is the Finance Minister of India. Under GST, goods and services are taxed at the following rates, 0%, 5%, 12% ,18% and 28%. There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold. In addition a cess of 15% or other rates on top of 28% GST applies on few items like aerated drinks, luxury cars and products. GST was initially proposed to replace a slew of indirect taxes with a unified tax and was therefore set to dramatically reshape the country's 2 trillion dollar economy. The rate of GST in India is between double to four times that levied in other countries like Singapore.

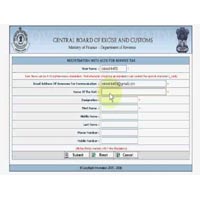

As per the government website on GST, "Goods and Services Tax" Network (GSTN) is a nonprofit organisation proposed to be formed for creating a website / platform for all the concerned parties related to the GST, namely stakeholders, government and taxpayers to collaborate on a single portal. When up and running, the portal is supposed to be accessible to the central government which allows it to track down every transaction on its end while taxpayers are advertised to have the ability of connecting this to their tax returns.

BENEFITS OF GOODS AND SERVICES TAX (GST)

For business and industry

For Central and State Governments :

For the consumer :

We are here to help you !!

Present Indirect structure is marked with following problems:

Presently, the Constitution empowers the Central Government to levy excise duty on manufacturing and service tax on the supply of services.

GST shall subsume the following taxes in the times to come once the law is in force:

GST will be applicable from 01 July 2017